Draft Budget 2026

Draft Budget 2026 Magazine and Explorer

With a complex budget, the City has introduced new supports like the Draft Budget 2026 Magazine and the Draft Budget 2026 Explorer to make understanding and engaging in the budget process easier.

The Budget Magazine provides insight into how the budget is created, what elements make up the budget, some of the key financials, an update on service reviews as well as highlights from over 100 lines of services that are advancing Council’s strategic priorities.

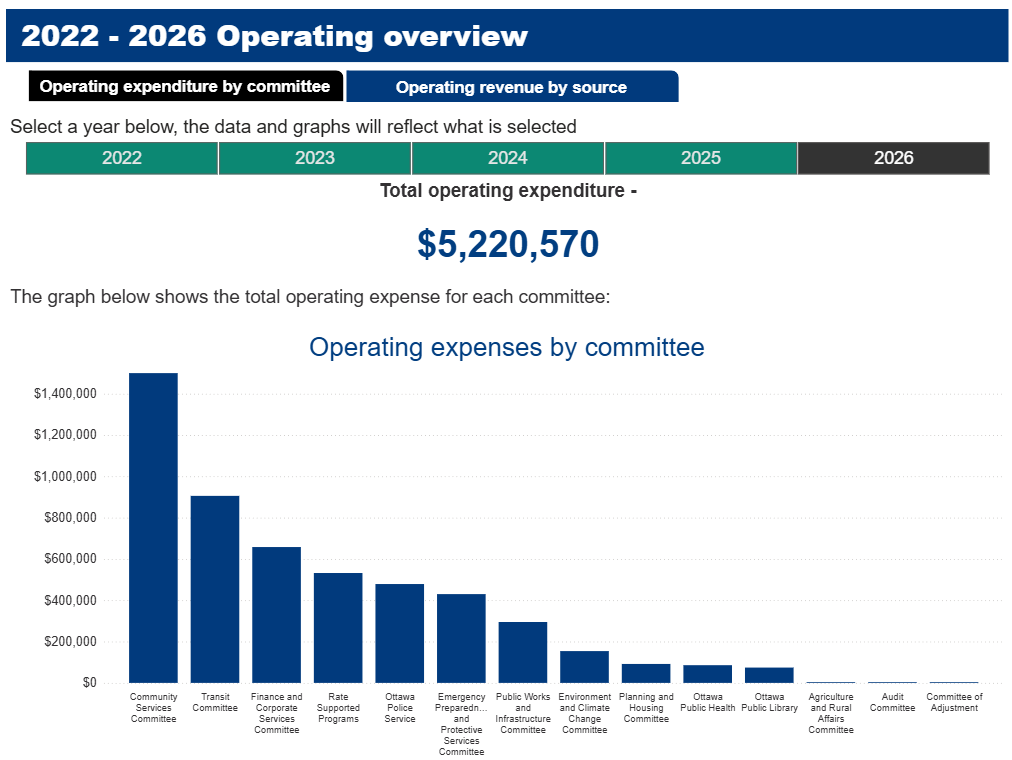

The Budget Explorer offers user-friendly interactive charts, graphs and tables to enhance financial literacy and transparency.

Opportunities for participation in the budget process

It’s your city, your budget, and we want to hear from you! The City of Ottawa engages with residents each year to gather ideas and feedback as it drafts the budget for City Council’s consideration. You have many opportunities to provide your input on items reflected in the budget year-round through your Councillor’s office, committee meetings, social media, contacting 3-1-1 and scheduled engagement opportunities during the budget process.

Your feedback helps shape the City’s budget priorities and contributes to decisions about investing in a sustainable, secure, and prosperous city for all.

Year-round:

- Submit your ideas to your Ward Councillor.

- Watch, attend or participate in committee and Council meetings to learn more about important decisions at City Hall.

- Provide input on public engagement opportunities that matter to you through Engage Ottawa.

- Follow and communicate with us on Facebook or Bluesky, using the hashtag #OttBudget

- Call 3-1-1 (TTY: 613-580-2401). Rural residents call 613-580-2400

Drafting the budget:

- Participate in the budget questionnaire from May 26 to June 30. Your responses on the city’s priorities will help shape the development of the draft budget.

- Participate in Councillor-led public consultations. Check back regularly on this page or Ottawa.ca as dates will be added as soon as they are available. Consultations will focus on how the budget is developed, what is within and outside the City’s control when it comes to drafting the budget, and to hear your feedback.

Feedback on the Draft Budget:

- The draft budget will be tabled at Council on November 12.

- Following tabling residents can provide feedback on the draft budget in the following ways:

- Ask questions through the City’s Engage Ottawa webpage. Question submissions will be open for the public between November 12 and December 8.

- Join us at a standing committee meeting. All City Council and standing committee meetings are open to the public and your attendance is welcomed and encouraged. Members of the public may provide either written or oral submissions (or both) to committee meetings related to items on the Committee’s agenda. Check back regularly on this page or on Ottawa.ca to stay current with the standing committee dates for budget considerations.

- You can live stream meetings and access past recordings on the Ottawa City Council YouTube Channel. Regular City Council meetings are broadcast live on RogersTV Cable 22 and live streamed on the RogersTV website.

Budget adoption:

- Council will approve the 2026 budget on December 10. The adopted budget books will be updated and posted to the 2026 Budget webpage in Q2 2026.

For more budget information, visit Ottawa.ca. Accessible formats and communication supports are available, upon request.

Draft Budget 2026 Magazine and Explorer

With a complex budget, the City has introduced new supports like the Draft Budget 2026 Magazine and the Draft Budget 2026 Explorer to make understanding and engaging in the budget process easier.

The Budget Magazine provides insight into how the budget is created, what elements make up the budget, some of the key financials, an update on service reviews as well as highlights from over 100 lines of services that are advancing Council’s strategic priorities.

The Budget Explorer offers user-friendly interactive charts, graphs and tables to enhance financial literacy and transparency.

Opportunities for participation in the budget process

It’s your city, your budget, and we want to hear from you! The City of Ottawa engages with residents each year to gather ideas and feedback as it drafts the budget for City Council’s consideration. You have many opportunities to provide your input on items reflected in the budget year-round through your Councillor’s office, committee meetings, social media, contacting 3-1-1 and scheduled engagement opportunities during the budget process.

Your feedback helps shape the City’s budget priorities and contributes to decisions about investing in a sustainable, secure, and prosperous city for all.

Year-round:

- Submit your ideas to your Ward Councillor.

- Watch, attend or participate in committee and Council meetings to learn more about important decisions at City Hall.

- Provide input on public engagement opportunities that matter to you through Engage Ottawa.

- Follow and communicate with us on Facebook or Bluesky, using the hashtag #OttBudget

- Call 3-1-1 (TTY: 613-580-2401). Rural residents call 613-580-2400

Drafting the budget:

- Participate in the budget questionnaire from May 26 to June 30. Your responses on the city’s priorities will help shape the development of the draft budget.

- Participate in Councillor-led public consultations. Check back regularly on this page or Ottawa.ca as dates will be added as soon as they are available. Consultations will focus on how the budget is developed, what is within and outside the City’s control when it comes to drafting the budget, and to hear your feedback.

Feedback on the Draft Budget:

- The draft budget will be tabled at Council on November 12.

- Following tabling residents can provide feedback on the draft budget in the following ways:

- Ask questions through the City’s Engage Ottawa webpage. Question submissions will be open for the public between November 12 and December 8.

- Join us at a standing committee meeting. All City Council and standing committee meetings are open to the public and your attendance is welcomed and encouraged. Members of the public may provide either written or oral submissions (or both) to committee meetings related to items on the Committee’s agenda. Check back regularly on this page or on Ottawa.ca to stay current with the standing committee dates for budget considerations.

- You can live stream meetings and access past recordings on the Ottawa City Council YouTube Channel. Regular City Council meetings are broadcast live on RogersTV Cable 22 and live streamed on the RogersTV website.

Budget adoption:

- Council will approve the 2026 budget on December 10. The adopted budget books will be updated and posted to the 2026 Budget webpage in Q2 2026.

For more budget information, visit Ottawa.ca. Accessible formats and communication supports are available, upon request.

Questions regarding City services and the 2026 budget may be submitted below until December 8, 2026.

Budget inquiries related to the Ottawa Police Services, Ottawa Public Library, or Ottawa Public Health should be directed to the following email addresses:

Subject matter experts will review and respond to inquiries, with a target response time of five business days.

-

Share I live in a very new apartment building, near several other new apartment buildings on Carling Ave at Merivale. The developers for our buildings most certainly paid exorbitant development charges and taxes to the city which have returned no service or amenity upgrades to the area. Bus service has declined radically since the latest re-organization despite having so many more people living in the area. I used to have direct bus connections to 3 different LRT stations, and now I can only reliably connect to 1 station, the furthest away from me on the other side of downtown, meaning I now have to frequently take more Ubers than previously. How can you justify the persistent underfunding of public transit, gutting services, while raising fares? Why is this budget continuing the death spiral of public transit in this city, while extracting massive taxes on new urban dwelling units? on Facebook Share I live in a very new apartment building, near several other new apartment buildings on Carling Ave at Merivale. The developers for our buildings most certainly paid exorbitant development charges and taxes to the city which have returned no service or amenity upgrades to the area. Bus service has declined radically since the latest re-organization despite having so many more people living in the area. I used to have direct bus connections to 3 different LRT stations, and now I can only reliably connect to 1 station, the furthest away from me on the other side of downtown, meaning I now have to frequently take more Ubers than previously. How can you justify the persistent underfunding of public transit, gutting services, while raising fares? Why is this budget continuing the death spiral of public transit in this city, while extracting massive taxes on new urban dwelling units? on Twitter Share I live in a very new apartment building, near several other new apartment buildings on Carling Ave at Merivale. The developers for our buildings most certainly paid exorbitant development charges and taxes to the city which have returned no service or amenity upgrades to the area. Bus service has declined radically since the latest re-organization despite having so many more people living in the area. I used to have direct bus connections to 3 different LRT stations, and now I can only reliably connect to 1 station, the furthest away from me on the other side of downtown, meaning I now have to frequently take more Ubers than previously. How can you justify the persistent underfunding of public transit, gutting services, while raising fares? Why is this budget continuing the death spiral of public transit in this city, while extracting massive taxes on new urban dwelling units? on Linkedin Email I live in a very new apartment building, near several other new apartment buildings on Carling Ave at Merivale. The developers for our buildings most certainly paid exorbitant development charges and taxes to the city which have returned no service or amenity upgrades to the area. Bus service has declined radically since the latest re-organization despite having so many more people living in the area. I used to have direct bus connections to 3 different LRT stations, and now I can only reliably connect to 1 station, the furthest away from me on the other side of downtown, meaning I now have to frequently take more Ubers than previously. How can you justify the persistent underfunding of public transit, gutting services, while raising fares? Why is this budget continuing the death spiral of public transit in this city, while extracting massive taxes on new urban dwelling units? link

I live in a very new apartment building, near several other new apartment buildings on Carling Ave at Merivale. The developers for our buildings most certainly paid exorbitant development charges and taxes to the city which have returned no service or amenity upgrades to the area. Bus service has declined radically since the latest re-organization despite having so many more people living in the area. I used to have direct bus connections to 3 different LRT stations, and now I can only reliably connect to 1 station, the furthest away from me on the other side of downtown, meaning I now have to frequently take more Ubers than previously. How can you justify the persistent underfunding of public transit, gutting services, while raising fares? Why is this budget continuing the death spiral of public transit in this city, while extracting massive taxes on new urban dwelling units?

ElieB asked 3 months agoThank you for your feedback regarding OC Transpo. We appreciate you taking the time to share your concerns about transit options in the Carling/Merivale area, especially given the significant growth and new development in your neighbourhood.

We have reviewed the current transit options near Carling and Merivale and found the following transit options at nearby stops. At Carling and Merivale, Stops #8094 and #8078 are served by Routes 85 Lees and 85 Bayshore, both operating approximately every 15 minutes for most of the day. Similarly, at Merivale and Carling, Stop #1030 offers service on Route 80 Tunney’s Pasture, while Stop #1029 provides service on Route 80 Barrhaven Centre, each also running about every 15 minutes throughout much of the day. We invite customers to consult our Travel Planner for stop schedules and individual trip plans.

We acknowledge your concerns about direct service to Transit Stations. Following the implementation of New Ways to Bus, some routes were retired or modified due to low ridership, to streamline service, and to improve connections to new routes and the O-Train network. We recognize that these changes mean some customers must now travel farther to reach a stop or make additional transfers.

Since the launch of the new network, we have been closely monitoring service delivery, ridership levels, and customer feedback, and we are tracking requests for additional service in areas where demand is increasing.

Your feedback has been forwarded to our Planning team for further review and consideration as we look at future adjustments to the New Ways to Bus network. As resources allow, certain adjustments may be introduced in coordination with our Seasonal Service Changes.

If you have a specific request regarding direct transit service to a particular station, we would be happy to forward it to OC Transpo for further consideration.

-

Share As a home owner for over 50 years, and a retired senior on a small income, it looks like the city is slowly pushing us seniors out of our homes by Taxing us into poverty! My taxes on my home are pushing $7000 a year, which i can not afford for much longer as i don't get Big raises every year on CPP,OAS and my small work pension, not to mention the astronomical cost of everything just to stay in my home! What are we supposed to Do, move to another town ! on Facebook Share As a home owner for over 50 years, and a retired senior on a small income, it looks like the city is slowly pushing us seniors out of our homes by Taxing us into poverty! My taxes on my home are pushing $7000 a year, which i can not afford for much longer as i don't get Big raises every year on CPP,OAS and my small work pension, not to mention the astronomical cost of everything just to stay in my home! What are we supposed to Do, move to another town ! on Twitter Share As a home owner for over 50 years, and a retired senior on a small income, it looks like the city is slowly pushing us seniors out of our homes by Taxing us into poverty! My taxes on my home are pushing $7000 a year, which i can not afford for much longer as i don't get Big raises every year on CPP,OAS and my small work pension, not to mention the astronomical cost of everything just to stay in my home! What are we supposed to Do, move to another town ! on Linkedin Email As a home owner for over 50 years, and a retired senior on a small income, it looks like the city is slowly pushing us seniors out of our homes by Taxing us into poverty! My taxes on my home are pushing $7000 a year, which i can not afford for much longer as i don't get Big raises every year on CPP,OAS and my small work pension, not to mention the astronomical cost of everything just to stay in my home! What are we supposed to Do, move to another town ! link

As a home owner for over 50 years, and a retired senior on a small income, it looks like the city is slowly pushing us seniors out of our homes by Taxing us into poverty! My taxes on my home are pushing $7000 a year, which i can not afford for much longer as i don't get Big raises every year on CPP,OAS and my small work pension, not to mention the astronomical cost of everything just to stay in my home! What are we supposed to Do, move to another town !

Mo$e$2232 asked 3 months agoThe City of Ottawa is required under the Ontario Municipal Act to maintain a balanced budget, meaning we cannot run deficits and must fund services through taxes, fees, and other revenues. While the City works to manage affordability, it is important to recognize that many cost pressures are outside municipal control. Rising mortgage rates, utility costs, and general inflation affect household budgets but also increase the cost of delivering municipal services. Construction costs, labour agreements, and regulatory requirements add further pressure. These external factors, combined with limited provincial and federal funding, make it challenging to maintain service levels without adjustments to local property taxes and fees.

To meet these demands, the Draft 2026 Operating and Capital Budget proposes an overall property tax increase of 3.75%, including a 2% citywide levy, 5% for Ottawa Police Services, and 8% for Transit Services. Ottawa continues to have the lowest property tax rates among Ontario’s 10 largest cities. For comparisons, visit the City of Ottawa Tax Policy page.

To support residents in managing their property tax payments, the City offers several helpful tools:

- The Pre-Authorized Debit (PAD) plan enables property owners to spread their annual tax payments into smaller, more predictable monthly installments. For convenience, I’ve attached the application form to this e-mail. Please note that each withdrawal will include a non-refundable service fee of $0.55, which will be automatically added to your withdrawal amount.

- The Property Tax Estimator estimates the total annual property taxes. This tool is designed for convenience, but only provides an estimate, not an official tax bill.

- Full or partial property tax deferral is available to eligible low-income seniors and persons with disabilities. These programs allow qualifying homeowners to defer their annual property taxes at a reduced interest rate, and a similar deferral program is also offered for water utility charges.

While outside of our scope, provincial programs such as the Senior Homeowner’s Property Tax Grant, which provides up to $500 annually, and the Ontario Energy and Property Tax Credit, which offers tax-free payments to help with property taxes and energy costs might also be beneficial. These programs require filing an annual income tax return, and more information can be found here: Property Tax Relief – Provincial Programs.

We hope this provides helpful context on the draft 2026 Budget.

-

Share One of Ottawa's Strategic Priorities is to be a Green and Resilience city. I noticed that a Climate Resilience lens has been applied to budget. Is there also an element that would incorporate the green buildings standards such as increased use of native plants and trees in municipal projects, rain gardens on municipal lands to reduce the amount of rain water flowing into the storm drains (e.g. boulevards on the LRT extension)? Would the use of elements such as Bird-Friendly glass, Dark-sky light be included as Climate Resiliency or does this fall into a separate category? on Facebook Share One of Ottawa's Strategic Priorities is to be a Green and Resilience city. I noticed that a Climate Resilience lens has been applied to budget. Is there also an element that would incorporate the green buildings standards such as increased use of native plants and trees in municipal projects, rain gardens on municipal lands to reduce the amount of rain water flowing into the storm drains (e.g. boulevards on the LRT extension)? Would the use of elements such as Bird-Friendly glass, Dark-sky light be included as Climate Resiliency or does this fall into a separate category? on Twitter Share One of Ottawa's Strategic Priorities is to be a Green and Resilience city. I noticed that a Climate Resilience lens has been applied to budget. Is there also an element that would incorporate the green buildings standards such as increased use of native plants and trees in municipal projects, rain gardens on municipal lands to reduce the amount of rain water flowing into the storm drains (e.g. boulevards on the LRT extension)? Would the use of elements such as Bird-Friendly glass, Dark-sky light be included as Climate Resiliency or does this fall into a separate category? on Linkedin Email One of Ottawa's Strategic Priorities is to be a Green and Resilience city. I noticed that a Climate Resilience lens has been applied to budget. Is there also an element that would incorporate the green buildings standards such as increased use of native plants and trees in municipal projects, rain gardens on municipal lands to reduce the amount of rain water flowing into the storm drains (e.g. boulevards on the LRT extension)? Would the use of elements such as Bird-Friendly glass, Dark-sky light be included as Climate Resiliency or does this fall into a separate category? link

One of Ottawa's Strategic Priorities is to be a Green and Resilience city. I noticed that a Climate Resilience lens has been applied to budget. Is there also an element that would incorporate the green buildings standards such as increased use of native plants and trees in municipal projects, rain gardens on municipal lands to reduce the amount of rain water flowing into the storm drains (e.g. boulevards on the LRT extension)? Would the use of elements such as Bird-Friendly glass, Dark-sky light be included as Climate Resiliency or does this fall into a separate category?

Deborah Doherty asked 3 months agoThank you for your interest in the City’s efforts to build a green and resilient Ottawa.

Many of the elements you raise are currently considered when designing municipal projects, including through bird-safety guidelines and selection of plant and tree species that are suitable for changing climate conditions.

In addition, the upcoming City’s Low Impact Development guidelines support the use of rain gardens, permeable paving and other on-site stormwater management to reduce the amount of runoff entering the storm sewer system.

Many of these elements will be reviewed when the City updates its Green Building Policy, planned for the coming years.

-

Share The city's fees, taxes and restrictive zoning bylaws on housing development exacerbates the housing crisis, cost of living crisis, homeless crisis, and drug-use epidemic in Canada, Ontario and the city of Ottawa. Experts agree that a missing middle of ground-level, family-sized dwellings within a price range of 3 to 5 times the medium Canadian annual income can have the largest impacts of the above-listed issues. Why is the reliance on development fees (380 million dollars in city revenue in 2024), continue to rise in the city budget year after year when it is well known and an established fact that rising taxes and fees on housing makes housing less affordable? on Facebook Share The city's fees, taxes and restrictive zoning bylaws on housing development exacerbates the housing crisis, cost of living crisis, homeless crisis, and drug-use epidemic in Canada, Ontario and the city of Ottawa. Experts agree that a missing middle of ground-level, family-sized dwellings within a price range of 3 to 5 times the medium Canadian annual income can have the largest impacts of the above-listed issues. Why is the reliance on development fees (380 million dollars in city revenue in 2024), continue to rise in the city budget year after year when it is well known and an established fact that rising taxes and fees on housing makes housing less affordable? on Twitter Share The city's fees, taxes and restrictive zoning bylaws on housing development exacerbates the housing crisis, cost of living crisis, homeless crisis, and drug-use epidemic in Canada, Ontario and the city of Ottawa. Experts agree that a missing middle of ground-level, family-sized dwellings within a price range of 3 to 5 times the medium Canadian annual income can have the largest impacts of the above-listed issues. Why is the reliance on development fees (380 million dollars in city revenue in 2024), continue to rise in the city budget year after year when it is well known and an established fact that rising taxes and fees on housing makes housing less affordable? on Linkedin Email The city's fees, taxes and restrictive zoning bylaws on housing development exacerbates the housing crisis, cost of living crisis, homeless crisis, and drug-use epidemic in Canada, Ontario and the city of Ottawa. Experts agree that a missing middle of ground-level, family-sized dwellings within a price range of 3 to 5 times the medium Canadian annual income can have the largest impacts of the above-listed issues. Why is the reliance on development fees (380 million dollars in city revenue in 2024), continue to rise in the city budget year after year when it is well known and an established fact that rising taxes and fees on housing makes housing less affordable? link

The city's fees, taxes and restrictive zoning bylaws on housing development exacerbates the housing crisis, cost of living crisis, homeless crisis, and drug-use epidemic in Canada, Ontario and the city of Ottawa. Experts agree that a missing middle of ground-level, family-sized dwellings within a price range of 3 to 5 times the medium Canadian annual income can have the largest impacts of the above-listed issues. Why is the reliance on development fees (380 million dollars in city revenue in 2024), continue to rise in the city budget year after year when it is well known and an established fact that rising taxes and fees on housing makes housing less affordable?

Sean Boivin asked 3 months agoThe City of Ottawa's Strategic plan (2023-2026) identifies a city that has affordable housing and is more liveable for all as one of the City's top strategic priorities. The City has taken several actions in support of this priority, including the following:

- On October 1, 2025, Council approved the new Housing Acceleration Plan which includes 53 actions, spread across five key objectives, to meaningfully tackle the housing crisis. Visit the city's website for additional insight into the five objectives and associated actions. Some examples of actions already taken include the deferral of Development Charge collection until Occupancy and waiving planning and building permit fees for non-profit affordable housing projects.

- New comprehensive zoning by-law review is underway and proposes increased density and housing choices in existing neighbourhoods, including the "missing middle" referenced in your question.

- The Vacant Unit Tax (VUT) program continues to identify and return underused housing units back to the market, while allocating all net proceeds towards the City's Affordable Housing Reserve providing additional funding for housing initiatives. The City's VUT annual reports provide more insight into results and key indicators of this program.

Ottawa's Development Charges are competitive and amongst the lowest in Ontario when compared with Municipalities of similar size, as demonstrated in a recent study published by the CMHC. Development Charges remain a necessary revenue stream to uphold the principle of "growth pays for growth." If this revenue were eliminated, the cost would immediately shift to the existing taxpayer base resulting in a significant property tax increase. Therefore, while the City is actively working to remove regulatory and cost barriers to increase development, maintaining DCs is essential to prevent a financial burden on current residents, ensuring that overall affordability in the city is not compromised by funding growth through taxes on established homes.

-

Share I noticed that 2026 property tax increase for Transit is projected at 8% while city wide increase is 2% and police is 5%, for overall 3.75% property tax increase. This 8% transit increase on property taxes appears excessive, particularly since fares are to increase only 2.5%. Can there be a decrease in the overall transit budget, or have riders absorb more of the cost increase rather than homeowners? What is the percentage share of transit costs borne by users vs. homeowners? on Facebook Share I noticed that 2026 property tax increase for Transit is projected at 8% while city wide increase is 2% and police is 5%, for overall 3.75% property tax increase. This 8% transit increase on property taxes appears excessive, particularly since fares are to increase only 2.5%. Can there be a decrease in the overall transit budget, or have riders absorb more of the cost increase rather than homeowners? What is the percentage share of transit costs borne by users vs. homeowners? on Twitter Share I noticed that 2026 property tax increase for Transit is projected at 8% while city wide increase is 2% and police is 5%, for overall 3.75% property tax increase. This 8% transit increase on property taxes appears excessive, particularly since fares are to increase only 2.5%. Can there be a decrease in the overall transit budget, or have riders absorb more of the cost increase rather than homeowners? What is the percentage share of transit costs borne by users vs. homeowners? on Linkedin Email I noticed that 2026 property tax increase for Transit is projected at 8% while city wide increase is 2% and police is 5%, for overall 3.75% property tax increase. This 8% transit increase on property taxes appears excessive, particularly since fares are to increase only 2.5%. Can there be a decrease in the overall transit budget, or have riders absorb more of the cost increase rather than homeowners? What is the percentage share of transit costs borne by users vs. homeowners? link

I noticed that 2026 property tax increase for Transit is projected at 8% while city wide increase is 2% and police is 5%, for overall 3.75% property tax increase. This 8% transit increase on property taxes appears excessive, particularly since fares are to increase only 2.5%. Can there be a decrease in the overall transit budget, or have riders absorb more of the cost increase rather than homeowners? What is the percentage share of transit costs borne by users vs. homeowners?

Hank asked 3 months agoThank you for your question. The Draft 2026 Transit Budget, as endorsed by the Transit Long-Range Financial Plan (LRFP) Working Group, allocates approximately 67% of transit operating costs to property taxes and 33% to fare revenue, representing a balanced and affordable approach to address significant financial challenges while continuing to invest in the transit system.

To keep costs as low as possible, the city continues to implement efficiency measures such as optimizing routes, reducing administrative overhead, and leveraging technology to improve operations. In addition, Ottawa actively seeks external funding from provincial and federal governments to offset costs. Programs like the federal Canada Public Transit Fund and provincial gas tax transfers provide millions in annual support, helping reduce the burden on both taxpayers and riders.

This funding approach is guided by oversight from the Transit LRFP Working Group, which ensures that financial decisions align with long-term sustainability and affordability goals. Both fares and the levy are increasing, but the levy remains the primary funding source for transit, supported by ongoing savings initiatives and external funding partnerships.

-

Share Thank you for your response to my questions, but I need additional clarification. For my question "Can you provide a list of all projects that will have cycling infrastructure?", you provided the list for the 2026 Cycling Facilities Program and then mention that there are other projects in different funding streams. Can you provide a list of all projects from all funding streams that will have cycling infrastructure? Your initial response also included: The Cycling Facilities Program budget for 2026 and previous years is summarized below: 2026 Budget - $16.3M (proposed) 2025 Budget - $9.9M 2024 Budget - $5.6M 2023 Budget - $7.5M But from a Budget consultation with my Councillor I got the following response: Response: Provided by Finance Services The budget numbers for cycling & MUP: 2023 - $18,708,000 2024 - $15,589,000 2025 - $15,786,000 Which numbers are correct? If the second ones, can you provide the numbers for 2026? Thanks. on Facebook Share Thank you for your response to my questions, but I need additional clarification. For my question "Can you provide a list of all projects that will have cycling infrastructure?", you provided the list for the 2026 Cycling Facilities Program and then mention that there are other projects in different funding streams. Can you provide a list of all projects from all funding streams that will have cycling infrastructure? Your initial response also included: The Cycling Facilities Program budget for 2026 and previous years is summarized below: 2026 Budget - $16.3M (proposed) 2025 Budget - $9.9M 2024 Budget - $5.6M 2023 Budget - $7.5M But from a Budget consultation with my Councillor I got the following response: Response: Provided by Finance Services The budget numbers for cycling & MUP: 2023 - $18,708,000 2024 - $15,589,000 2025 - $15,786,000 Which numbers are correct? If the second ones, can you provide the numbers for 2026? Thanks. on Twitter Share Thank you for your response to my questions, but I need additional clarification. For my question "Can you provide a list of all projects that will have cycling infrastructure?", you provided the list for the 2026 Cycling Facilities Program and then mention that there are other projects in different funding streams. Can you provide a list of all projects from all funding streams that will have cycling infrastructure? Your initial response also included: The Cycling Facilities Program budget for 2026 and previous years is summarized below: 2026 Budget - $16.3M (proposed) 2025 Budget - $9.9M 2024 Budget - $5.6M 2023 Budget - $7.5M But from a Budget consultation with my Councillor I got the following response: Response: Provided by Finance Services The budget numbers for cycling & MUP: 2023 - $18,708,000 2024 - $15,589,000 2025 - $15,786,000 Which numbers are correct? If the second ones, can you provide the numbers for 2026? Thanks. on Linkedin Email Thank you for your response to my questions, but I need additional clarification. For my question "Can you provide a list of all projects that will have cycling infrastructure?", you provided the list for the 2026 Cycling Facilities Program and then mention that there are other projects in different funding streams. Can you provide a list of all projects from all funding streams that will have cycling infrastructure? Your initial response also included: The Cycling Facilities Program budget for 2026 and previous years is summarized below: 2026 Budget - $16.3M (proposed) 2025 Budget - $9.9M 2024 Budget - $5.6M 2023 Budget - $7.5M But from a Budget consultation with my Councillor I got the following response: Response: Provided by Finance Services The budget numbers for cycling & MUP: 2023 - $18,708,000 2024 - $15,589,000 2025 - $15,786,000 Which numbers are correct? If the second ones, can you provide the numbers for 2026? Thanks. link

Thank you for your response to my questions, but I need additional clarification. For my question "Can you provide a list of all projects that will have cycling infrastructure?", you provided the list for the 2026 Cycling Facilities Program and then mention that there are other projects in different funding streams. Can you provide a list of all projects from all funding streams that will have cycling infrastructure? Your initial response also included: The Cycling Facilities Program budget for 2026 and previous years is summarized below: 2026 Budget - $16.3M (proposed) 2025 Budget - $9.9M 2024 Budget - $5.6M 2023 Budget - $7.5M But from a Budget consultation with my Councillor I got the following response: Response: Provided by Finance Services The budget numbers for cycling & MUP: 2023 - $18,708,000 2024 - $15,589,000 2025 - $15,786,000 Which numbers are correct? If the second ones, can you provide the numbers for 2026? Thanks.

ddomen613 asked 3 months agoCycling infrastructure is delivered through several City program areas, not just the Cycling Facilities program. Cycling elements are incorporated into a wide range of road, safety, and mobility projects across the city. These projects are delivered by multiple departments, and there is no single city-wide list of cycling initiatives.

The budget figures previously shared reflect the Cycling Facilities Program allocations. The numbers referenced through your Councillor’s office include some of the other City programs that have cycling elements, including cycling renewal, cycling safety, and active transportation structures. The comparable amount for 2026 is $28.9M.

-

Share Last year we saw a significant increase to property taxes and also a large increase to the cost of waste management, which was difficult to bear for the citizens of ottawa. Here we are again with a big increase for 2026 (along with other services). Before mayor Sutcliffe property taxes did not increase more than 2%, and the city was prosperous. Why is the mayor pushing his citizens into poverty? Every year I have to make concessions on where I spend in order to cover the increased property tax. This is not sustainable for the average family and homeowner, cost of everything continues to rise while salaries stagnate. Perhaps there’s a way to Adjust the budget to SPEND LESS, so that citizens don't bear the burden further. Or Bring in more investment revenue from other sources to cover costs. Does the city not have a financial advisor, project advisor, etc. to help with managing such things? This cannot continue on this trajectory as citizens will struggle more financially and not be able to afford the basic things in life. Thank you for your attention to this matter. on Facebook Share Last year we saw a significant increase to property taxes and also a large increase to the cost of waste management, which was difficult to bear for the citizens of ottawa. Here we are again with a big increase for 2026 (along with other services). Before mayor Sutcliffe property taxes did not increase more than 2%, and the city was prosperous. Why is the mayor pushing his citizens into poverty? Every year I have to make concessions on where I spend in order to cover the increased property tax. This is not sustainable for the average family and homeowner, cost of everything continues to rise while salaries stagnate. Perhaps there’s a way to Adjust the budget to SPEND LESS, so that citizens don't bear the burden further. Or Bring in more investment revenue from other sources to cover costs. Does the city not have a financial advisor, project advisor, etc. to help with managing such things? This cannot continue on this trajectory as citizens will struggle more financially and not be able to afford the basic things in life. Thank you for your attention to this matter. on Twitter Share Last year we saw a significant increase to property taxes and also a large increase to the cost of waste management, which was difficult to bear for the citizens of ottawa. Here we are again with a big increase for 2026 (along with other services). Before mayor Sutcliffe property taxes did not increase more than 2%, and the city was prosperous. Why is the mayor pushing his citizens into poverty? Every year I have to make concessions on where I spend in order to cover the increased property tax. This is not sustainable for the average family and homeowner, cost of everything continues to rise while salaries stagnate. Perhaps there’s a way to Adjust the budget to SPEND LESS, so that citizens don't bear the burden further. Or Bring in more investment revenue from other sources to cover costs. Does the city not have a financial advisor, project advisor, etc. to help with managing such things? This cannot continue on this trajectory as citizens will struggle more financially and not be able to afford the basic things in life. Thank you for your attention to this matter. on Linkedin Email Last year we saw a significant increase to property taxes and also a large increase to the cost of waste management, which was difficult to bear for the citizens of ottawa. Here we are again with a big increase for 2026 (along with other services). Before mayor Sutcliffe property taxes did not increase more than 2%, and the city was prosperous. Why is the mayor pushing his citizens into poverty? Every year I have to make concessions on where I spend in order to cover the increased property tax. This is not sustainable for the average family and homeowner, cost of everything continues to rise while salaries stagnate. Perhaps there’s a way to Adjust the budget to SPEND LESS, so that citizens don't bear the burden further. Or Bring in more investment revenue from other sources to cover costs. Does the city not have a financial advisor, project advisor, etc. to help with managing such things? This cannot continue on this trajectory as citizens will struggle more financially and not be able to afford the basic things in life. Thank you for your attention to this matter. link

Last year we saw a significant increase to property taxes and also a large increase to the cost of waste management, which was difficult to bear for the citizens of ottawa. Here we are again with a big increase for 2026 (along with other services). Before mayor Sutcliffe property taxes did not increase more than 2%, and the city was prosperous. Why is the mayor pushing his citizens into poverty? Every year I have to make concessions on where I spend in order to cover the increased property tax. This is not sustainable for the average family and homeowner, cost of everything continues to rise while salaries stagnate. Perhaps there’s a way to Adjust the budget to SPEND LESS, so that citizens don't bear the burden further. Or Bring in more investment revenue from other sources to cover costs. Does the city not have a financial advisor, project advisor, etc. to help with managing such things? This cannot continue on this trajectory as citizens will struggle more financially and not be able to afford the basic things in life. Thank you for your attention to this matter.

Salem asked 4 months agoThe City of Ottawa is required under the Ontario Municipal Act to maintain a balanced budget each year, which means the City cannot run deficits and must fund all services and infrastructure through taxes, fees, and other revenues. Ottawa is facing significant growth pressures, with its population projected to increase by approximately 402,000 people by 2046, reaching 1.41 million residents. This growth will require additional private dwellings and expanded infrastructure, placing increased demands on water, wastewater, transit, roads, and emergency services. While the City works to manage affordability, it is important to recognize that many cost pressures are outside municipal control. Rising mortgage rates, utility costs, and general inflation affect household budgets but also increase the cost of delivering municipal services. Construction costs, labour agreements, and regulatory requirements add further pressure. These external factors, combined with limited provincial and federal funding, make it challenging to maintain service levels without adjustments to local property taxes and fees.

As per Council direction, In 2023 the City launched two programs aimed at finding cost savings and finding operational efficiencies. The Service Review Framework involved formally evaluating City services to identify opportunities for cost savings and revenue generation to reinvest in strategic priorities from this Term of Council. As a compliment to the Service Review Framework, the Continuous Service Improvement program focuses on creating organizational capacity by simplifying, automating and standardizing processes, which in turn has helped departments absorb growth without the need for additional resources. From a financial perspective, these efforts have achieved a cumulative savings of more than $252 million in this term of Council’s budgets. These savings have helped the City avoid passing on a 12% increase in property taxes to residents.

-

Share I'm interested in safety in Ottawa Community Housing. Is this under Community Services Committee? I see there is $550,000 investment to improve safety within their buildings. Plus $2million and $1.44 million What is the increase in FTE's for OCH Security section? What other safety measures will this funding be used for? on Facebook Share I'm interested in safety in Ottawa Community Housing. Is this under Community Services Committee? I see there is $550,000 investment to improve safety within their buildings. Plus $2million and $1.44 million What is the increase in FTE's for OCH Security section? What other safety measures will this funding be used for? on Twitter Share I'm interested in safety in Ottawa Community Housing. Is this under Community Services Committee? I see there is $550,000 investment to improve safety within their buildings. Plus $2million and $1.44 million What is the increase in FTE's for OCH Security section? What other safety measures will this funding be used for? on Linkedin Email I'm interested in safety in Ottawa Community Housing. Is this under Community Services Committee? I see there is $550,000 investment to improve safety within their buildings. Plus $2million and $1.44 million What is the increase in FTE's for OCH Security section? What other safety measures will this funding be used for? link

I'm interested in safety in Ottawa Community Housing. Is this under Community Services Committee? I see there is $550,000 investment to improve safety within their buildings. Plus $2million and $1.44 million What is the increase in FTE's for OCH Security section? What other safety measures will this funding be used for?

Cheryl Parrott asked 4 months agoThe $550K increase to Ottawa Community Housing’s (OCH) Community Safey Services (CSS) will assist OCH in maintaining current service levels of the CSS program.

CSS has been operational since 2007 and OCH has been working closely with the City to address an existing funding gap for CSS which has grown over the years due to the growth in need. The City remains committed to working with OCH to provide incremental increases in funding to ensure the viability of the CSS program as a priority.

The CSS model of safety services is a 24/7 service specifically aimed at implementing sustainable solutions to address community safety and wellbeing in a social housing context. Their work reduces calls for service to other agencies such as the Ottawa Police Service, Ottawa Fire Services, Ottawa By-law Services, and Emergency Management Services while also helping to speed up referrals to needed supports, reduce the impact of negative incidents on the broader community, and preserve the tenancies of vulnerable tenants.

For more information related to the CSS program, please reach out to OCH directly at info@och.ca.

The $2M and $144K amounts referenced in the draft budget are not related to CSS.

-

Share Can you provide a list of all projects that will have cycling infrastructure? Can you also note which projects are at risk of cycling infrastructure removal as a results of the new Ontario government bill? Can you also provide the current and past years cycling budget? Thank you. on Facebook Share Can you provide a list of all projects that will have cycling infrastructure? Can you also note which projects are at risk of cycling infrastructure removal as a results of the new Ontario government bill? Can you also provide the current and past years cycling budget? Thank you. on Twitter Share Can you provide a list of all projects that will have cycling infrastructure? Can you also note which projects are at risk of cycling infrastructure removal as a results of the new Ontario government bill? Can you also provide the current and past years cycling budget? Thank you. on Linkedin Email Can you provide a list of all projects that will have cycling infrastructure? Can you also note which projects are at risk of cycling infrastructure removal as a results of the new Ontario government bill? Can you also provide the current and past years cycling budget? Thank you. link

Can you provide a list of all projects that will have cycling infrastructure? Can you also note which projects are at risk of cycling infrastructure removal as a results of the new Ontario government bill? Can you also provide the current and past years cycling budget? Thank you.

ddomen613 asked 4 months agoProjects proposed for funding in the 2026 Cycling Facilities Program are listed in the Draft 2026 Budget and include:

- Byron and Churchill protected intersection

- O’Connor Street cycling facilities (Laurier to Wellington)

- Albert and Slater cycling facilities (Bay to Elgin)

- Albert Street cycling facilities (City Centre to Empress)

- Brian Coburn Boulevard pathway (Mer Bleue to Aquarium)

- Pavement marking and signage upgrades on several corridors

Cycling infrastructure is also delivered through a range of project streams, including integrated road renewals, road safety initiatives, and new road and transit projects. Staff are currently assessing the implications of Bill 60 on projects with cycling elements. More information can be found in the following report: Potential Implications of Bill 60 on Cycling Projects and Recommendations for the 2026 Capital Budget

The Cycling Facilities Program budget for 2026 and previous years is summarized below:

2026 Budget - $16.3M (proposed)

2025 Budget - $9.9M

2024 Budget - $5.6M

2023 Budget - $7.5M

-

Share Why is solid waste increasing 10%? I thought the province was to be responsible for the pickup of recycling material effective 2026 which should reduce the city’s cost for this program. Appreciate clarification on understanding this charge increase. on Facebook Share Why is solid waste increasing 10%? I thought the province was to be responsible for the pickup of recycling material effective 2026 which should reduce the city’s cost for this program. Appreciate clarification on understanding this charge increase. on Twitter Share Why is solid waste increasing 10%? I thought the province was to be responsible for the pickup of recycling material effective 2026 which should reduce the city’s cost for this program. Appreciate clarification on understanding this charge increase. on Linkedin Email Why is solid waste increasing 10%? I thought the province was to be responsible for the pickup of recycling material effective 2026 which should reduce the city’s cost for this program. Appreciate clarification on understanding this charge increase. link

Why is solid waste increasing 10%? I thought the province was to be responsible for the pickup of recycling material effective 2026 which should reduce the city’s cost for this program. Appreciate clarification on understanding this charge increase.

Frank Martin asked 4 months agoSince 2023, curbside residents have not been paying for recycling collection (and processing) services. The City has been under contract with Circular Materials and has been compensated for the residential recycling collection through that contract. This was incorporated in the development of the City's Long-Range Financial Plan for Solid Waste Services 2025-2034 which provides a forecast of future rate increases and ensures the City can meet it's current and future capital needs for Solid Waste Services as presented in the City's Solid Waste Master Plan.

Ottawa’s solid waste fee is a single, rate-based charge that funds all waste services. Every household pays the same rate, which directly supports waste operations rather than relying on property taxes. In 2025, the cost per household was $265 — lower than in most similar-sized cities. This fee covers:

- Implement the action suites of the Solid Waste Master Plan

- Continue collecting garbage, green bin, and yard waste

- Providing recycling at City facilities, parks, and small businesses, which are not part of the new provincial program

- Operate the City’s Trail Waste Facility

- Organize and run the City’s Household Hazardous Waste Events

The City will continue to provide efficient garbage and organics collection and also focus on waste reduction and diversion initiatives.

Language Switch

Who's Listening

-

General Manager, Finance and Corporate Services and Chief Financial Officer

City of Ottawa

Email Budget@ottawa.ca -

SV

Email Budget@ottawa.ca

Councillor-led public consultations

-

October 15 2025

-

October 25 2025

-

October 28 2025

-

October 29 2025

-

November 03 2025

Key Dates

-

December 01 2025

-

December 01 2025

-

December 02 2025

-

December 02 2025

-

December 04 2025

-

December 05 2025

Thank you for your contribution!

Help us reach out to more people in the community

Share this with family and friends